Dear readers,

Deep in underground salt caverns of Texas and Louisiana lies the largest (known) emergency crude oil storage facility in the world: The Strategic Petroleum Reserve (SPR).

What is the Strategic Petroleum Reserve?

Since 1975, the United States government has amassed a federal oil stockpile. It’s been an important foreign policy tool and served as emergency protection in energy markets. But that is now quickly changing.

Let’s break it down.

Why was the SPR created?

The SPR was established in 1975, following the oil embargo of 1973-1974, which caused severe disruptions in the global oil market and created economic turmoil in the United States. In response, Congress authorized the creation of the SPR to provide a cushion against future oil supply disruptions.

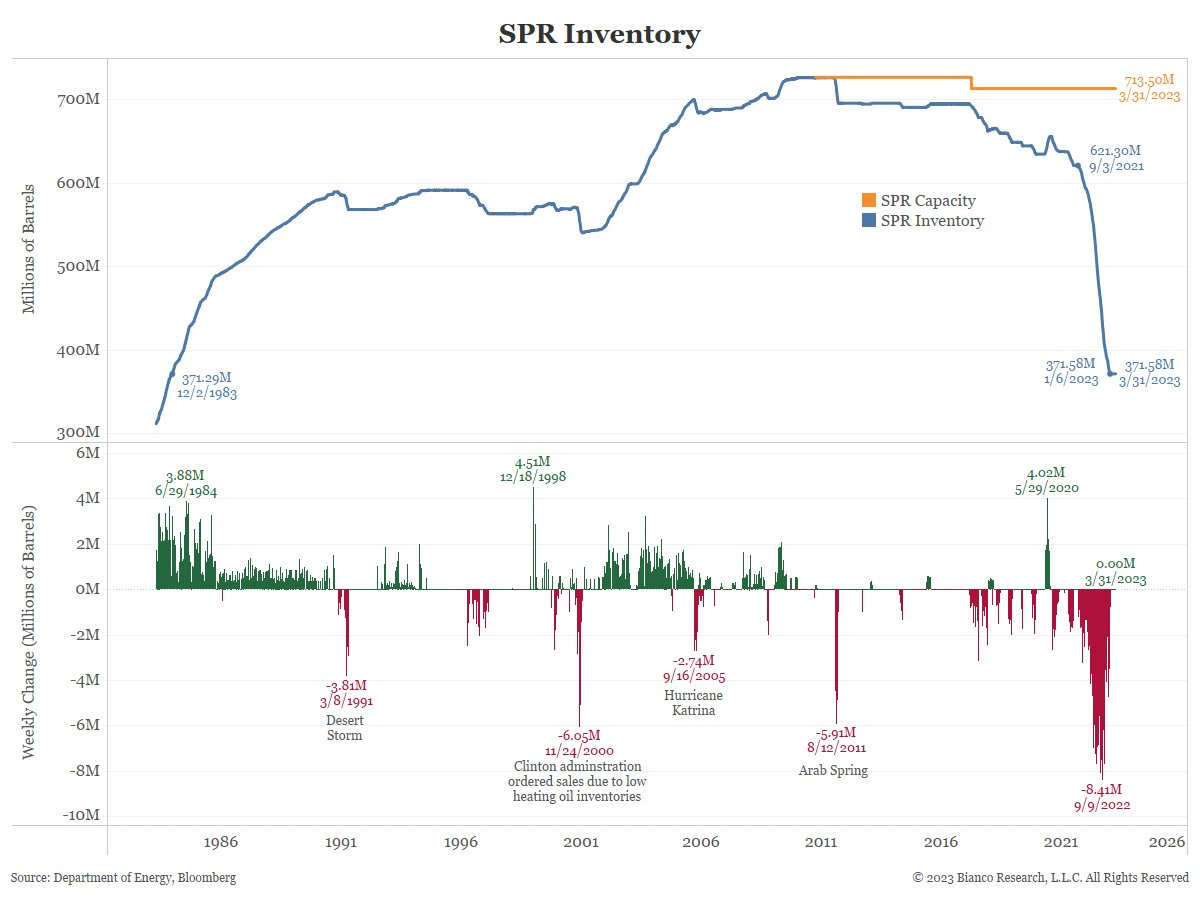

Since its creation, the SPR has been used four times to help stabilize the global oil market.

In 1991 during the Gulf War, when President George H.W. Bush authorized the release of 17 million barrels of crude oil from the SPR to address the loss of supply due to the conflict.

The aftermath of Hurricane Katrina in 2005, when President George W. Bush authorized the release of 30 million barrels to help offset the loss of refining capacity in the Gulf Coast region.

2011 when President Barack Obama tapped into the SPR in 2011 due to the conflict in Libya releasing 30 million barrels to help offset the loss of supply.

2022 when Joe Biden directed the largest ever sale of the SPR at the outset of the Ukraine War releasing 1M barrels a day. A total of 180M barrels were released bring the stockpile to its lowest level since 1983.

Why is the SPR important? SPR Dynamics in 2022-2023

The role of the SPR has evolved. From simply being an emergency oil stockpile to a U.S. foreign policy tool to finally an emergency domestic measure. In the past, the SPR was used to stabilize prices, prevent economic disruption and to pressure other countries to comply with U.S. foreign policy goals. For example, in 2018, the Trump administration considered tapping into the SPR to offset the loss of Iranian oil supply due to sanctions, which would have put pressure on other countries to reduce their imports of Iranian oil.

Today the SPR has become a last ditch effort to address deeper structural energy problems the US is facing, backfiring sanctions on Russia and a deteriorating relationship with Saudi Arabia. The Biden administration has now run down the SPR to its lowest point in its history.

With the looming 2022 midterms, the SPR quickly became a way to control skyrocketing domestic gas prices after Russian sanctions backfired badly. Following a surprisingly successful midterm run by the Democrats, the late Fall 2022 brought the SPR balance to a 300~ million barrel low, the administration made a commitment to restock the SPR at lower prices ($67-72 range). In March of this year oil prices dropped to $69 (from the $80 range) and yet energy secretary Jennifer Granholm declined to follow through. By early Spring 2023, OPEC+ announced a surprise supply cut and prices surged back to the $80+ range. The Saudi’s were irritated. The Biden administration had publicly reneged on their commitment to replenish the stockpile and in response secretary Granholm inexplicably claimed: “[the administration] hopes to refill it at lower oil prices if it's advantageous to taxpayers during the rest of the year”.

If oil prices surge further this year the US will have been caught in a bad position. Biden has visited Riyadh twice now seeking a OPEC production increase and has only seen the opposite develop. Geopolitical alliances continue to shift as Saudi Arabia turns increasingly to the East coordinating with Russia and China and even easing tensions with Iran. Will the US-Saudi Petro Alliance continue to decline? Ultimately, Saudi’s biggest client is no longer the US, but China. And it appears Saudi is prepared to do what’s needed to keep their biggest client happy.

Thanks for reading,

Nadir